When it comes to financial independence, the journey starts with one essential tool: budgeting. You can’t control what you don’t measure, and a budget helps you measure and manage your finances effectively. While many people see budgeting as restrictive or tedious, it’s actually a powerful tool that gives you freedom—the freedom to decide how you spend your money, save for your future, and ultimately achieve financial independence (FI).

Let’s dive into why mastering your budget is the first, crucial step to breaking free from the 9 to 5 grind and building the life you want.

Why Budgeting Matters

A budget is essentially a plan for your money. Without one, it’s easy to lose track of where your income goes and fall into financial traps, such as overspending, accumulating debt, or living paycheck to paycheck. Budgeting allows you to see the big picture of your financial situation, helping you allocate your money toward your priorities rather than spending impulsively.

For those aiming for FI, a budget is a way to align your current spending with your future goals. It forces you to examine your financial habits, understand your needs versus your wants, and make deliberate choices that move you closer to freedom.

How to Create a Budget

- Track Your Income and Expenses

Start by listing all your sources of income and all your regular expenses. Be honest with yourself and track everything—rent/mortgage, utilities, groceries, transportation, entertainment, subscriptions, occasional travelling, and more. It can be surprising to see where your money actually goes. Most modern banks have phone apps that can help you keep track of your expenses. You can also use one of the many paid apps such as YNAB. I personally use Revolut app that comes for free with their modern banking app. You can read more about that later at the end of this article. Otherwise, a simple spreadsheet will do the job.

- Track Your Income and Expenses

- Choose a Budgeting Method

Different people find success with different budgeting methods, so find one that suits you:- Zero-Based Budgeting: Allocate every dollar, euro, or whatever currency of your income to a specific category (savings, bills, debt, etc.), so you end up with “zero” unallocated at the end of the month.

- 50/30/20 Rule: Allocate 50% of your income to needs (housing, food, etc.), 30% to wants (entertainment, dining out), and 20% to savings or paying off debt.

- Pay Yourself First: This method is my favorite and one of the most popular ones. Prioritize saving a set percentage of your income before you spend anything else. This is great for building wealth.

- Choose a Budgeting Method

- Set Financial Goals

Financial independence isn’t a one-size-fits-all goal. Define what it looks like for you—whether it’s saving for an emergency fund, paying down high-interest debt, investing, or generating passive income streams. Your goals will shape how you allocate your budget.

- Set Financial Goals

- Adjust and Adapt

Budgeting is not a set-it-and-forget-it task. It’s important to review your budget regularly, especially as your financial situation changes. Did you receive a raise? Did your expenses increase? Make adjustments to keep your budget aligned with your goals.

- Adjust and Adapt

It all might sound tedious micromanagement of your financials, but once you get used to it, it will not take much thinking. Everything will be on auto-pilot when you get your salary at the end of the month. The key is to get started with the steps above and stick to it for long enough until it becomes your new normal.

Budgeting for Financial Independence

Budgeting becomes especially powerful when it’s aligned with the bigger goal of financial independence. Once you’ve mastered the basics, here are a few advanced tactics to fast-track your journey:

- Cut Unnecessary Expenses: Identify and eliminate expenses that don’t bring real value to your life. For instance, cancel unused subscriptions or limit dining out. Redirect the savings toward debt repayment or investments. It’s worth noting that do not forget yourself. Do spend money on experiences, especially with the people you love. Your beautiful memories pay dividend later on in life.

- Increase Your Savings Rate: One of the quickest ways to achieve financial independence is to increase the percentage of your income that goes into savings or investments. Aim to save at least 20-30% of your income if you can, and increase it over time. Even if you’re far from 20% at the moment, aim for 1% increase every one or two of months.

- Build an Emergency Fund: Before you start investing, ensure you have a robust emergency fund. This fund should cover 3 to 6 months of living expenses, giving you a safety net in case of job loss or unexpected expenses.

Revolut, My Favorite Banking Tool

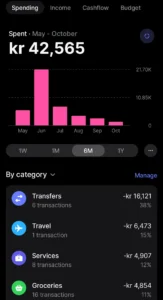

As I quickly mentioned above, my personal go-to all-in-one finance app is Revolut. When you sign up for Revolut, not only you get a bank account and debit card without any annual fee, but also you get a free personal finance management app to handle your budgeting needs. In addition to all of that, Revolut provides excellent exchange rate when you convert or transfer money to anywhere in the world. If you’re an expat and would like to transfer money between your local bank account and the account you have in your home country, or if like me you have assets in different countries and would like a simple multi-currency account, Revolut is the best choice available on the market right now.

You can use my referral link to sign up for free and I’ll get a small bonus.

The Freedom of Budgeting

At first glance, budgeting might seem like a chore, but it’s the foundation of financial freedom. By knowing where your money is going and making conscious decisions about how to allocate it, you take control of your financial future.

Budgeting isn’t about deprivation—it’s about empowerment. It allows you to prioritize the things that matter most and cut out what doesn’t. Once you start budgeting you’ll be surprised how much money you’re spending on things that don’t make any difference in your life. Multiply that by 12 and you’ll see how it adds up. With a solid budget in place, you’re laying the groundwork for financial independence and a life of freedom on your terms.

So, start today. Take control of your budget, and take the first step toward escaping the 9 to 5 grind for good.